OVERVIEW OF E-INVOICING FOR BUSINESS DIGITALISATION

Watch our video series to learn about Malaysia's National E-Invoicing Initiative highlighting its benefits to businesses, the roles of MDEC and LHDNM, how Peppol network enables global interoperability, and how to choose the right implementation model for your business.

OBJECTIVE

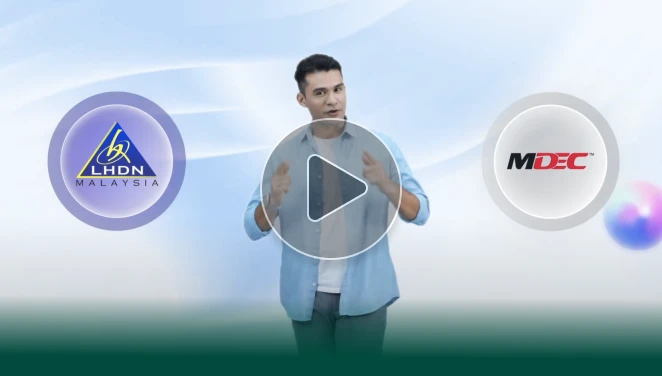

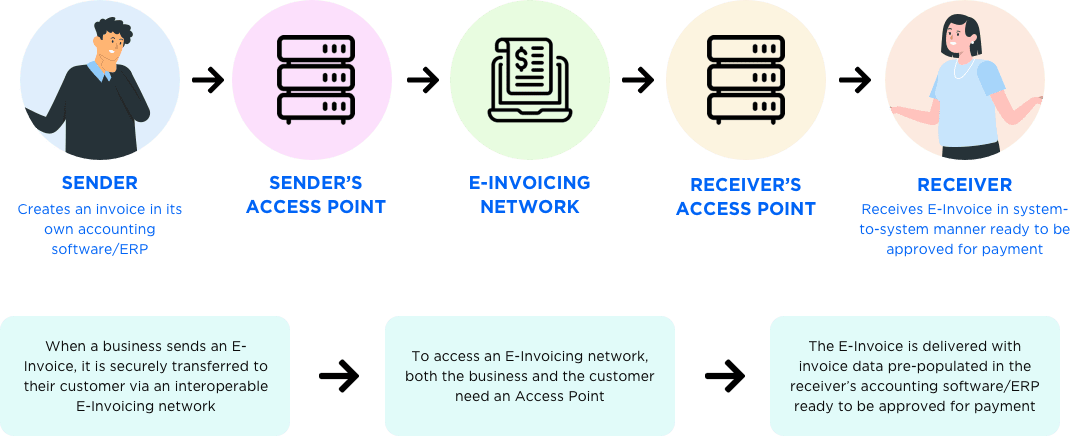

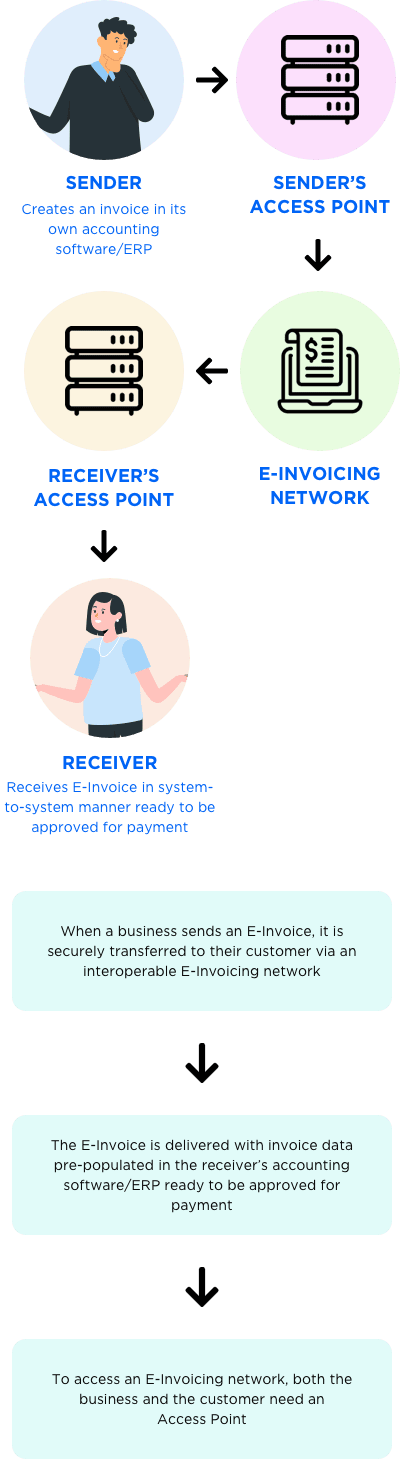

The National E-Invoicing Initiative aims to drive interoperable E-Invoicing by digitalising how businesses send invoices to other businesses, allowing different accounting software and Enterprise Resource Planning (ERP) systems to send and receive e-invoices in a system-to-system manner.

The Benefits

INCREASE BUSINESS

EFFICIENCY

Manual data entry and physical paper handling processes can be eliminated through the implementation of E-Invoicing. As a result, businesses can transact invoices more efficiently and seamlessly, with accurate traceability.

IMPROVE

CASHFLOW

With E-Invoicing, billing and calculation errors can be reduced significantly, thus accelerating payments and minimise disputes in irregularities.

EFFICIENT TAX

COMPLIANCE

The implementation of a compliant interoperable E-Invoicing framework will ensure an organised work process and facilitate effective tax reporting.

Malaysia’s Peppol Solution and Service Providers:

Freemium and Affordable E-Invoicing Solutions for SMEs

Empowering SMEs with Affordable Peppol and LHDNM-Compliant E-Invoicing Solutions

Peppol Service Providers (SP)

Peppol Service Providers (or Access Point (AP) Providers) are responsible for creating and maintaining the gateways that connect businesses and software to the E-Invoicing network.

Learn about the requirements to become a Peppol SP in Malaysia.

Peppol-Ready Solution Providers (PRSP)

Peppol-Ready Solution Providers are accounting software, ERP or solutions that provide the functionality of sending and receiving e-Invoice without necessarily becoming an Access Point (AP).

Learn about the requirements to become a PRSP in Malaysia.

Malaysia PINT Specifications

Peppol International Invoice (PINT) is the specification that facilitates interoperable exchange of invoices across the Peppol Network at a global level.

Learn more information on Malaysia PINT specifications.

Events Happening

This event offers valuable e-invoicing solutions from the accredited Peppol Service Providers (SP) in an exhibition set up and networking opportunities. Prepare your business for the upcoming mandatory tax compliance effective 1 August 2024. Don’t miss this opportunity to enhance your knowledge and connect with experts in the field.

Frequently Asked Questions

Under PINT-MY , the mandatory document types supported in Malaysia include:

- Invoice

- Credit Note

- Self Billing Invoice

Enabled Commercial Documents in Malaysia SMP:

- Peppol Order Transaction 3.0

- Peppol Order Response Transaction 3.0

- Peppol Invoice Response Transaction 3.0

- Peppol Despatch Advice Transaction 3.0

What this means for businesses?

These documents allow automation beyond invoicing, covering:

- Purchase Orders

- Order acceptance/rejection

- Shipping/despatch updates

- Supplier fulfilment processes

Peppol is not just an invoicing system, it’s a full B2B trade automation network.

When you adopt e-Invoicing using Peppol, this ID allows other businesses and systems to find you and send invoices to you correctly.

In Malaysia, the Peppol ID is created using your company’s SSM registration number, so that invoices are always linked to the correct business. If the information does not match official records, the business may not be able to use e-Invoicing properly.

For reference, the latest Malaysia Peppol ID Specification is available at: Malaysia Peppol ID

Registration may fail if the Peppol ID information does not match SSM records, such as an incorrect company number, wrong state code, outdated details, or if the company is inactive or dormant.

To avoid issues, businesses should ensure their Peppol ID is created using accurate and up-to-date SSM information before registration.

The LHDNM MyInvois system provides an API endpoint called “Get Document Details”, which allows authorised taxpayers or their appointed Peppol Service Providers to retrieve invoice information and its validation status directly from MyInvois.

More information is available at: MyInvois SDK - Get Document Details

For participants connected through the Malaysia Peppol Network, validation can also be verified using the PINT MY (Malaysia Peppol Invoice Transaction) specifications. By combining the invoice UUID embedded in the Peppol payload with the MyInvois API, buyer systems can confirm whether the e-Invoice received has been validated and approved by LHDN.

Refer to the PINT MY Syntax Specification for detailed guidance on UUID structure and integration within the Malaysia Peppol Network: Malaysia electronic document specifications

PRSP accreditation is generally more accessible for software vendors, system integrators and ERP providers, as it focuses on solution readiness, Peppol document compliance, and integration capability. Becoming a PRSP enables companies to deliver Peppol-enabled solutions directly to end users, expand their market reach and participate more actively in Malaysia’s growing e-Invoicing ecosystem. MDEC, as Malaysia’s Peppol Authority, encourages more vendors to pursue PRSP accreditation to accelerate nationwide adoption and to provide businesses with a wider choice of Peppol-ready solutions.

On the other hand, setting up and operating a Peppol Access Point (SP) involves significant technical, operational and security commitments, including maintaining AS4 messaging compliance, high-availability infrastructure, certificate lifecycle management and continuous monitoring. These requirements may pose challenges for many vendors who do not specialise in managed network services.

Organisations that wish to pursue dual accreditation (SP + PRSP) may do so, but must independently meet the full technical, procedural and compliance requirements for each category. Accreditation in one category does not automatically qualify a company for the other.

Please refer to the accreditation criteria for SP and PRSP at: SP Accreditation Guidelines and PRSP Accreditation Guidelines.